Fund search

The simple way to your fund.

Go to fund search

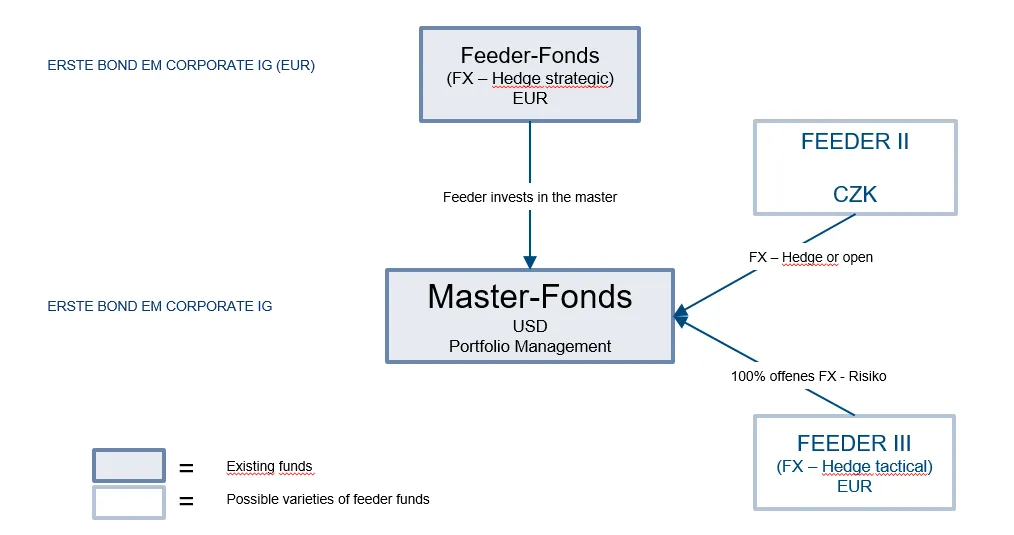

Go to fund searchThe option of master-feeder structures was introduced in Europe with implementation of the UCITS IV Directive. Such structures comprise a master fund, which invests in securities, money-market instruments, investment funds, sight deposits or callable deposits and/or derivative instruments, as specified in the master fund’s investment strategy. There may be one or several feeder funds to the master fund. The feeder funds invest at least 85% of their fund assets in the master fund. Apart from investing in the master fund, feeder funds may only invest in sight deposits and callable deposits, as well as derivatives for hedging purposes.

This solution makes sense where:

By using master-feeder structures the investment company can meet different client requirements more effectively. The securities portfolio of a master fund, which is bigger when compared with several smaller investment funds, can be managed more effectively and more cost-efficiently.

The chart exemplifies the master-feeder structure on the basis of the ERSTE BOND EM CORPORATE IG* fund. It illustrates two forms of possible feeders.